As you may know, on April 10th, 2022, Law 7/2022 of April 8, on waste and contaminated soils for a circular economy (hereinafter, LRSC) entered into force. This Act introduces a new indirect tax levied on the manufacturing, import and intra-EU acquisitions of non-reusable plastic containers, with effect from 1 January 2023.

Although for the time being there is no regulatory development (we are all waiting for it), the fact is that this tax poses important problems in terms of its implementation as it triggers the obligation to report a series of data, both in the return that is pending for approval and in the stock ledgers.

It should be noted that from a practical perspective, this tax is a hybrid between VAT and excise duties as it requires the maintenance of a stock ledger based on data totally alien to the fiscal / financial world and that, in many cases have not been registered in the companies’ ERP, such as for example the weight of non- recycled plastic contained in the packaging.

Therefore, the main problem we are facing is the identification of the data to be reported or the obligation to certify the weight of recycled plastic of the containers since, although until January 1st, 2024, it would be possible for the suppliers to provide a responsible declaration regarding the content of recycled plastic, as from 1st January 2024 onwards an official certification will be required.

It is important to note that, when facing such a project, there are a series of questions that allow us to size its scope affecting the purchases and / or sales flows of the containers used for raw materials, intermediate products and / or finished products.

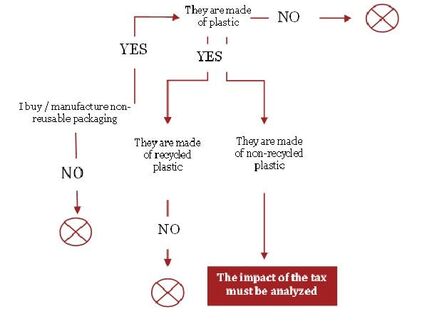

Thus, in the case of purchase flows, the basic questions would be the following:

Although for the time being there is no regulatory development (we are all waiting for it), the fact is that this tax poses important problems in terms of its implementation as it triggers the obligation to report a series of data, both in the return that is pending for approval and in the stock ledgers.

It should be noted that from a practical perspective, this tax is a hybrid between VAT and excise duties as it requires the maintenance of a stock ledger based on data totally alien to the fiscal / financial world and that, in many cases have not been registered in the companies’ ERP, such as for example the weight of non- recycled plastic contained in the packaging.

Therefore, the main problem we are facing is the identification of the data to be reported or the obligation to certify the weight of recycled plastic of the containers since, although until January 1st, 2024, it would be possible for the suppliers to provide a responsible declaration regarding the content of recycled plastic, as from 1st January 2024 onwards an official certification will be required.

It is important to note that, when facing such a project, there are a series of questions that allow us to size its scope affecting the purchases and / or sales flows of the containers used for raw materials, intermediate products and / or finished products.

Thus, in the case of purchase flows, the basic questions would be the following:

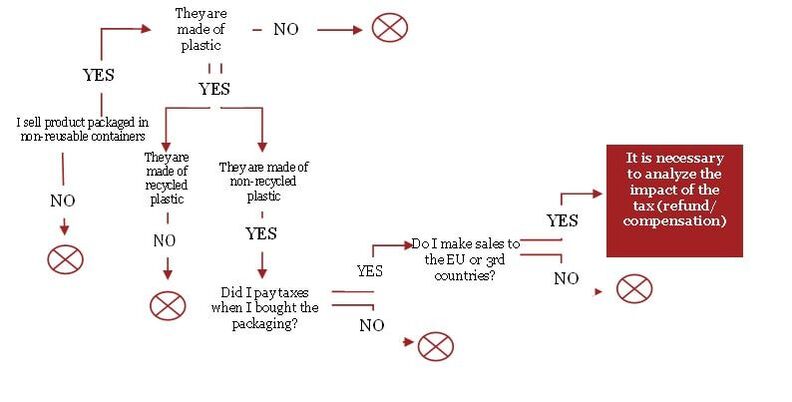

As for sales flows, the questions would be as follows:

If after answering any of these questions, you conclude that your organization could be affected by this tax, in bln palao abogados, S.L.P. together with MAROSA we will be happy to arrange an appointment or meeting, in order to analyze in greater detail the impact of this tax on your organization and, where appropriate, detail our work methodology that combines a solid knowledge of indirect taxes and extensive experience in issues related to the so-called tax technology.

Belén Palao Bastardés

Partner Director- bln palao abogados, S.L.P.

belen.palao@blnpalao.com

Pedro Pestana da Silva

Partner Director- MAROSA

pps@marosavat.com

Belén Palao Bastardés

Partner Director- bln palao abogados, S.L.P.

belen.palao@blnpalao.com

Pedro Pestana da Silva

Partner Director- MAROSA

pps@marosavat.com

Canal RSS

Canal RSS