Seminar on the carbon border adjustment mechanism (CBAM)

On the 3rd October, our managing director Belén Palao Bastardés had the pleasure to participe in a seminar organized by CEOE and BLN PALAO ABOGADOS where we analyse, together with other four main experts main, the main aspects concerning the carbon border adjustement mechanism.

We would like to thank CEOE and Pablo Renieblas, Customs and excise duties partner at #DeloitteLegal, Juan José Blanco, Customs and excise duties partner at #KPMGAbogados, Pedro Gonzalez-Gaggero, Customs, excise duties and environmental tax partner at #EY and Enrique Tejedor, customs and excise duties partner at #PWC for their participation in the event.

We would like to thank CEOE and Pablo Renieblas, Customs and excise duties partner at #DeloitteLegal, Juan José Blanco, Customs and excise duties partner at #KPMGAbogados, Pedro Gonzalez-Gaggero, Customs, excise duties and environmental tax partner at #EY and Enrique Tejedor, customs and excise duties partner at #PWC for their participation in the event.

Paper nº 20 issued by AEDAF concerning the Spanish plastic tax

Last Monday 25th September, our managing director, Belén Palao Bastardés presented to the press the paper nº 20 published by AEDAF. In such a document, our managing partner analyses the tax from a formal and technical perspective and raises her doubts on the alignment of this tax with the European regulation and basically with the goods free circulation principles as there are founded grounds to consider that the current wording of the plastic tax may infringe such a principle.

Should you like to have a copy of the report, please get in touch or contact directly #AEDAF.

Should you like to have a copy of the report, please get in touch or contact directly #AEDAF.

Carbon border adjustment mechanism

Last 14th July 2021, the European Commission presented a proposal for a Regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism (hereinafter, CBAM), with which it is intended to match the carbon price paid for EU products operating under the EU Emission Trading Scheme (EU ETS) and for imported products. This will only be possible by forcing companies importing into the EU to buy so-called CBAM certificates, in order to pay for the difference between the carbon price paid in the country of production and the carbon price in the EU ETS.

The CBAM Regulation is part of the Fit for 55 package of measures and is an essential element in achieving EU climate neutrality by 2050. To know more about this topic please click into this link.

The CBAM Regulation is part of the Fit for 55 package of measures and is an essential element in achieving EU climate neutrality by 2050. To know more about this topic please click into this link.

How to implement tax on non reusable plastic containers

|

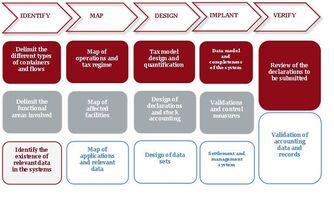

Recently, bln palao abogados has entered into an agreement with MAROSA to assist all their clients in the analysis and implementation of this new tax that comes into force as of January 1, 2023.

With a unique methodology and approach in the market, this agreement allows us to face this new tax from an practical perspective, focusing all our efforts in the analysis of data with a view to its parameterization in the ERP or the implementation of an automatic data supply system. |

In case you will be interested in obtaining more information on this tax, in bln palao abogados, S.L.P. together with MAROSA we will be happy to arrange an appointment or meeting, in order to analyze in greater detail the impact of this tax on your organization and, where appropriate, detail our work methodology that combines a solid knowledge of indirect taxes and extensive experience in issues related to the so-called tax technology. Should this be the case, please click on the following link: tax on non reusable plastic containers